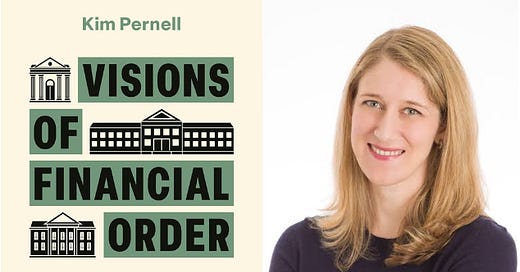

On this episode of the Extra Credit podcast, we talk to Kim Pernell, assistant professor of sociology in UT Austin’s College of Liberal Arts, about her new book, Visions of Financial Order: National Institutions and the Development of Banking Regulation, her personal and academic background, and how to think more holistically about the nature of regulation and its roots in national cultures.

Pernell’s new book is an extraordinarily deep exploration of what she calls the “principles of order” that shape and constrain the history of financial regulation in the U.S., Canada, and Spain. And if the words “financial regulation” are scaring you off, don’t fear! Underneath those regulations are all the assumptions nations and institutions make about risk, wealth, and the possibilities for change. In short, thinking and talking about the world of financial policy can ultimately tell us a lot about what we do or don’t prioritize and why.

In Visions of Financial Order, Pernell begins in the late 18th century and then moves all the way to the 2008 financial crisis in the three countries she studies. Along the way she identifies in each nation a set of fundamental tensions — and tracks the surprising ways each nation’s priorities and regulatory regimes evolve.

“Institutions are not monolithic,” she says. “They are composed of multiple principles of order, which can sometimes clash. These conflicts create opportunities for change, especially in moments of crisis. At the same time, these institutions also limit the types of changes that are possible.”

During our conversation, Kim takes us through her journey from growing up in Houston during the Enron scandal to becoming a scholar fascinated by organizational decision-making and systemic risk. We explore the pivotal moments that shaped her research, including the global financial crisis, and unpack the deeper meanings of her work. From the collapse of Enron to the intricacies of regulation, Kim offers profound insights into why countries regulate financial institutions differently and how these choices impact society.

-By Daniel Oppenheimer

Share this post